Iowa State Married Filing Jointly Filer Tax Rates, Thresholds and Settings Iowa State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction Read across to the column marked Your Tax Is. Iowa State Personal Income Tax Rates and Thresholds in 2023 $ 0.00 - $ 1,515.00 To find your tax: Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. 2021 IA 1040 TAX TABLES For All Filing Statuses To find your tax: Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. Iowa State Single Filer Tax Rates, Thresholds and Settings Iowa State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction These income tax brackets and rates apply to Iowa taxable income earned Januthrough December 31, 2022. If you would like additional elements added to our tools, please contact us. The Iowa Married Filing Separately filing status tax brackets are shown in the table below. The Iowa 1040 instructions and the most commonly filed individual income tax forms are listed below on this page. The state income tax table can be found inside the Iowa 1040 instructions booklet. The Iowa tax tables here contain the various elements that are used in the Iowa Tax Calculators, Iowa Salary Calculators and Iowa Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. The Iowa income tax rate for tax year 2022 is progressive from a low of 0.33 to a high of 8.53.

Iowa income tax tables 2020 full#

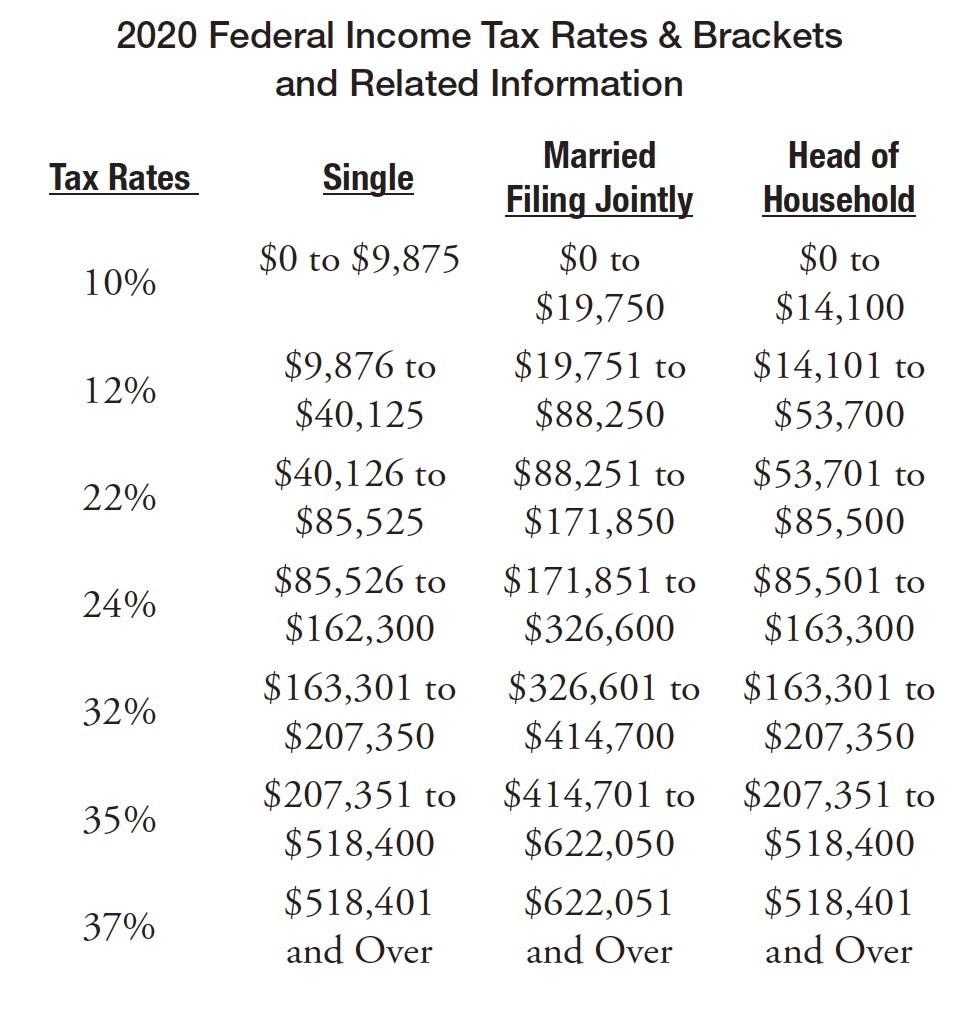

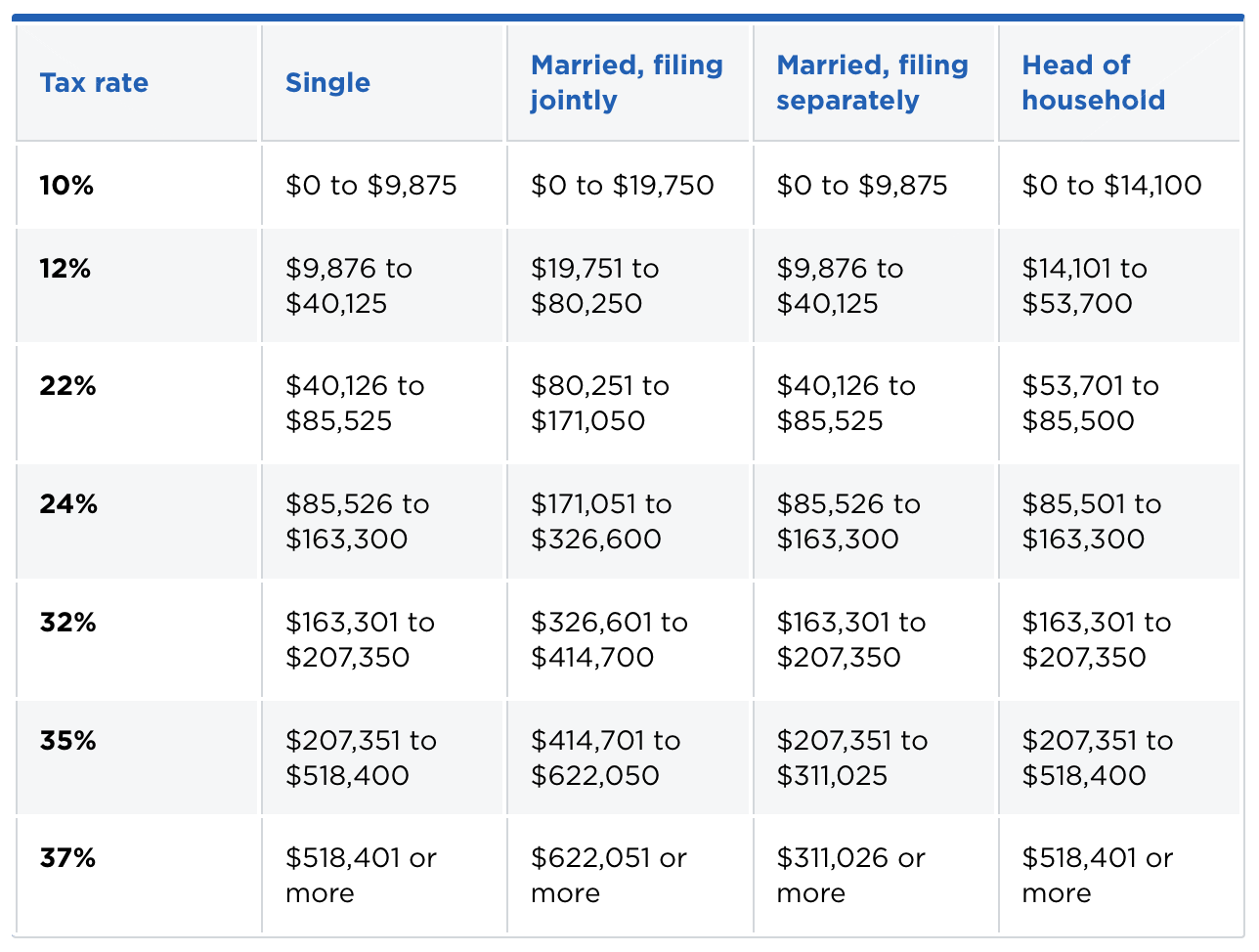

The Iowa State Tax Tables below are a snapshot of the tax rates and thresholds in Iowa, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the Iowa Department of Revenue website. This page contains references to specific Iowa tax tables, allowances and thresholds with links to supporting Iowa tax calculators and Iowa Salary calculator tools.

Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. The Iowa Department of Revenue is responsible for publishing the latest Iowa State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Iowa. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Plan & Book Transportation (Airfare, POV, etc.) Privately Owned Vehicle Mileage Rates Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. The Iowa State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Iowa State Tax Calculator.

0 kommentar(er)

0 kommentar(er)